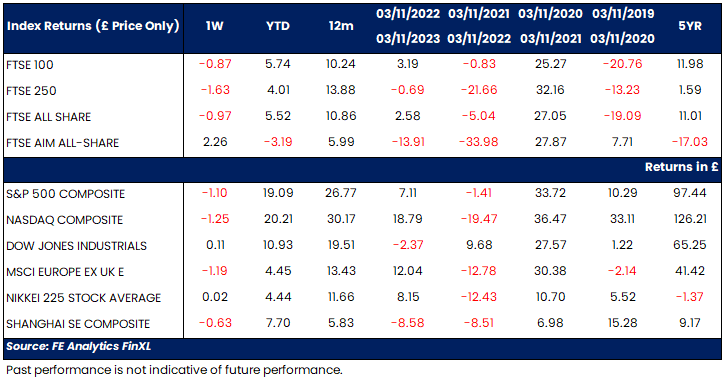

Labour and the Chancellor unveiled their first budget for fourteen years last week with spending plans for the next five years laid out. A major expansion in government spending was announced (£70.0bn), funded by a significant increase in taxation (£40.0bn) and borrowing (£32.0bn)[1] with the Office for Budget Responsibility (OBR) suggesting the Chancellor’s plans could ultimately lead to a deterioration in economic growth rates over the longer term[2]. Despite a bounce on Friday, UK equities lost ground during the week with the FTSE 100 and FTSE 250 declining by -0.9% and -1.6% respectively. Whilst the Chancellor did announce a reduction in inheritance tax relief on AIM shares, the fact that some relief remained in place provided a much needed boost for the AIM market which rose by +2.3%, the bulk of that spike coming after the budget update on Wednesday.

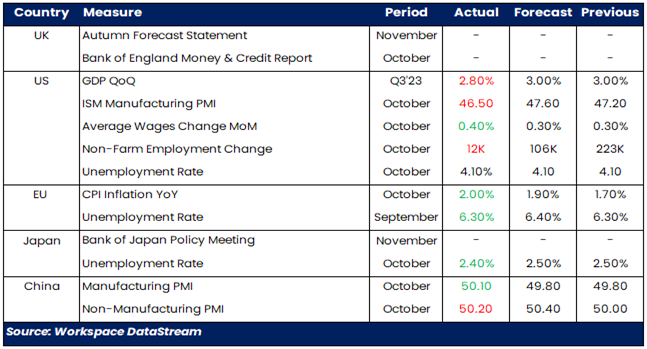

Elsewhere, US Equities lost ground in what was a busy week for the publication of earnings results. The S&P500 fell by -1.4% in dollar terms, with growth stocks lagging their value counterparts in part due to cautious updates from the likes of Alphabet, Meta Platforms and Microsoft[3]. Friday’s US jobs report also gave investors much to ponder with the US economy adding just 12,000 jobs last month which was the lowest recorded since December 2020[4]. Returning to Europe, the MSCI Europe ex UK index declined by -1.2% in euro terms despite a better than expected GDP report covering the third quarter. Germany, France and Spain all reported improved output during the quarter although Italy flatlined[5].

Moving to Asia, the Nikkei 225 added +0.4% (local currency) after the Bank of Japan elected to hold interest rates steady at last week’s policy meeting. Meanwhile in China, the Shanghai Composite shed -0.8% (local currency) despite various economic indicators including the official manufacturing sector Purchasing Manager Index (PMI) and new home sales, pointing towards an improved economic backdrop.

Week Ahead

| Day | Country | Measure | Period | Forecast | Previous |

| Monday | N/A | - | - | - | - |

| Tuesday | US | ISM Manufacturing PMI | October | 53.40 | 54.90 |

| US | US Presidential Election | November | - | - | |

| Wednesday | Europe | Final Services PMI | October | 51.20 | 51.20 |

| UK | Construction PMI | October | 55.30 | 57.20 | |

| Thursday | Europe | Retail Sales MoM | October | 0.40% | 0.40% |

| UK | Bank of England Policy Meeting | November | - | - | |

| US | Federal Reserve Policy Meeting | November | - | - | |

| Friday | N/A | - | - | - | - |

Source: Refinitiv Workspace, 04/11/24

[1] HM Treasury – Autumn Budget 2024

[2] Office for Budget Responsibility – Economic & Fiscal Outlook October 2024

[3] T. Rowe Price – Global Markets Weekly Update 01/11/2024

[4] US Bureau of Labor Statistics – Employment Situation Summary October 2024

[5] Eurostat – Q3’24 GDP

Past performance is not indicative of future performance.

The value of an investment may fall as well as rise. You may get back less than the amount invested.

The value of investments may fall as well as rise purely on account of exchange rate fluctuations.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. “FTSE Russell®” is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group

does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2024. All rights reserved

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

The information contained does not constitute investment advice. It is not intended to state, indicate or imply that current or past results are indicative of future results or expectations.

Full advice should be taken to evaluate the risks, consequences and suitability of any prospective investment. Opinions provided are subject to change in the future as they may be influenced by changes in regulation or market conditions. Where the opinions of third parties are offered, these may not necessarily reflect those of Rowan Dartington.

Rowan Dartington is part of the St. James’s Place Wealth Management Group. Rowan Dartington & Co. Limited is a member firm of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. Registered in England & Wales No. 02752304 at St. James’s Place House, 1 Tetbury Road, Cirencester, England, GL7 1FP, United Kingdom.

SJP Approved 04/11/2024